41 payment coupon for irs

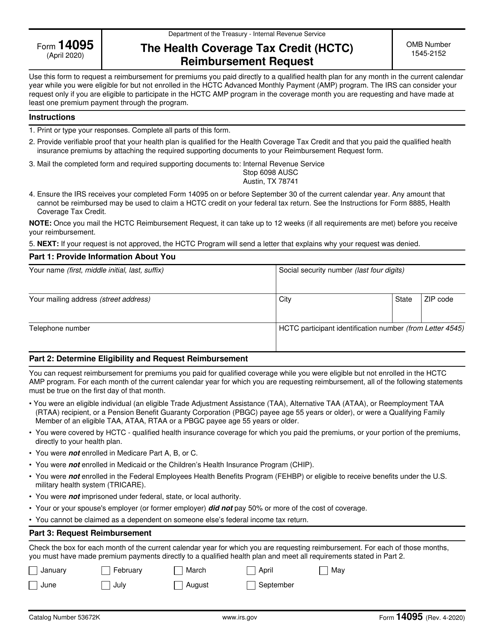

Health Care Coverage Tax Credit Payments Businesses and Self Employed IRS will make advance monthly payments every 20th day of the month to HPAs for 100% of monthly participant insurance premiums. It generally takes up to 5 business days to process payments. We will only accept payments for one month at a time. Making Your Monthly HCTC Payment to the AMP HCTC Program Forms and Instructions (PDF) - apps.irs.gov Election for Alternative to Payment of the Imputed Underpayment - IRC Section 6226. 1020. 10/30/2020. Form 14781. Electronic Federal Tax Payment System (EFTPS) Insolvency Registration. 1220. 01/13/2021. Form 1138. Extension of Time For Payment of Taxes By a Corporation Expecting a Net Operating Loss Carryback.

› makeapaymentPay1040.com - IRS Authorized Payment Provider The trusted and secure way to make business tax return payments to the IRS with your credit or debit card for a low fee.

Payment coupon for irs

How do I get Form 1040-V? - Intuit Form 1040-V (Payment Voucher) is an optional form that you can include with your check payment if you owe the IRS at the time of filing. If you're paper-filing and are paying via check, we'll include the 1040-V with your tax return printout, along with mailing instructions. fiscal.treasury.gov › files › eftpsELECTRONIC FEDERAL TAX PAYMENT SYSTEM PAYMENT INSTRUCTION BOOKLET If you are paying an amount due on an IRS notice that includes penalty or interest, it is not necessary to split the payment. Use tax type 94107 to pay the entire amount of a Form 941 notice. The IRS is cracking down on digital payments. Here's what it means for ... It is going to be up to the taxpayer, if they receive a 1099 in any form for a nontaxable event, such as splitting rent among roommates, splitting a dinner bill, or even selling something on eBay ...

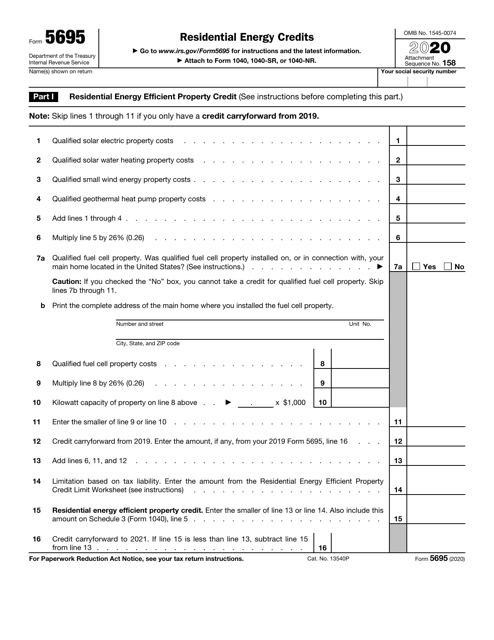

Payment coupon for irs. Zero-Coupon Swap Definition - Investopedia A zero-coupon swap is an exchange of cash flows in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap, but where the stream of... 7 Ways To Send Payments to the IRS You can typically take an extension by filing Form 4868 with the IRS (instead of a tax return) by the tax filing deadline, giving you until October 18, 2022, to submit your return. But any payment you owe is still due by the original tax due date, which is April 18 in 2022 for 2021 tax returns. 3 You should submit your tax payment along with ... 2021 Form 1040-V - Internal Revenue Service Payment Voucher. ▷ Do not staple or attach this voucher to your payment or return. ▷ Go to for payment options and information.2 pages Form 1040-ES Payment Voucher - Intuit The following is pasted from the Instructions to Form 1040-ES: of the following apply. 1. You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and refundable credits. 2. You expect your withholding and refundable credits. b. 100% of the tax shown on your 2021 tax return.

Montana Corporate Income Tax Payment Voucher (Form CT) Montana Corporate Income Tax Payment Voucher (Form CT) December 28, 2021 You may use this form to make corporate income tax payments. You can pay your corporate tax liability with your paper voucher or by using one of our e-pay options: TransAction Portal (TAP) or By making an ACH Credit Payment. Available in our TransAction Portal (TAP) Download › how-to-setup-an-irs-paymentYour Guide to IRS Payment Plans - The Balance The IRS failure-to-pay penalty is 0.5% per month for each month you're late, up to 25% of the amount you owe, plus interest. 1 The IRS adjusts its interest charges quarterly. They're always set at the federal short-term rate plus 3%. The interest rate is 3% for individual taxpayers for the fourth quarter of 2021. 2 Should 1040-V payment voucher check be sent with t... The payment voucher at the bottom of Form 1040-V should be detached and mailed with your tax return and payment. The voucher asks for four main pieces of information. Line 1: Your Social Security number (SSN) Line 2: The SSN of your spouse, if you're filing a joint return. Line 3: The amount you are paying via check or money order. Enrolling in Advance Monthly Payments of the Health Coverage Tax Credit ... Include the bottom portion of the HCTC payment coupon with your payment. Failure to provide all required information could delay processing of your payment or the return of your payment if, after research, the IRS cannot verify payment posting. Mail the payment coupon along with your payment to: US Treasury - HCTC P.O. Box 970023

How self-employed individuals and household employers ... - IRS tax forms The Coronavirus Aid, Relief, and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years. Half of the deferred Social Security tax is due by December 31, 2021, and the remainder is due by December 31, 2022. IRS continues work to help taxpayers; suspends mailing of additional ... The IRS sends this notice when a payment has not been received for an unpaid balance. This notice is a Notice of Intent to Levy (Internal Revenue Code Section 6331 (d)). 2802C: Withholding Compliance letter: This letter is mailed to taxpayers who have been identified as having under-withholding of Federal tax from their wages. This letter ... savingtoinvest.com › irs-refund-schedule-and2022 IRS Refund Schedule and Direct Deposit Payment Dates ... Apr 15, 2022 · The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start of the current tax season. It is organized by IRS’ WMR/IRS2Go processing status. The dates are just week ending estimates and should not be construed as official IRS payment dates. 2018 Form 1040-V - Internal Revenue Service Form 1040-V. Department of the Treasury. Internal Revenue Service (99). Payment Voucher. ▷ Do not staple or attach this voucher to your payment or return.2 pages

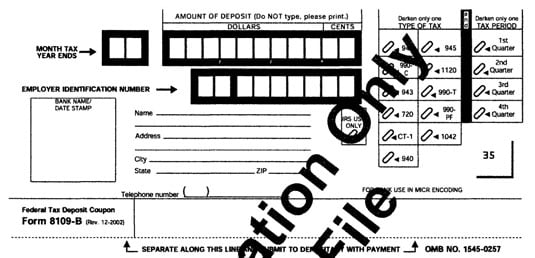

Generating estimated tax vouchers for an 1120 Corporation This includes installments payments of estimated tax. Forms 8109 and 8109-B, Federal Tax Coupon, can no longer be used to make federal tax deposits. Generally, electronic funds transfers are made using the Electronic Federal Tax Payment System (EFTPS).

IRS reminder to many: Make final 2021 quarterly tax payment by Jan. 18 ... Taxpayers who paid too little tax during 2021 can still avoid a surprise tax-time bill and possible penalty by making a quarterly estimated tax payment now, directly to the Internal Revenue Service. The deadline for making a payment for the fourth quarter of 2021 is Tuesday, January 18, 2022. Income taxes are pay-as-you-go.

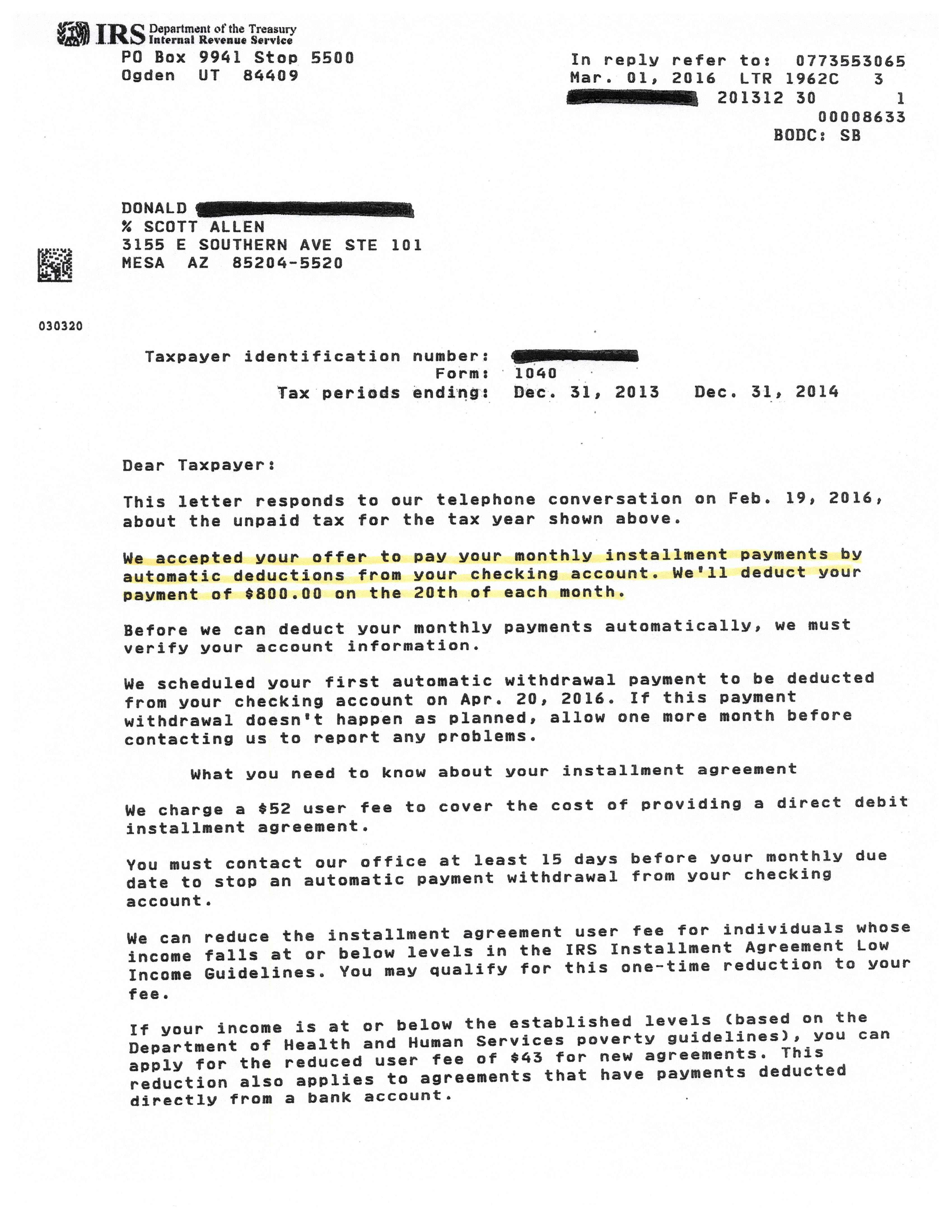

IRS Tax Payment Plans. Installments or Offer in Compromise Otherwise, apply by phone at 1-800-829-1040 or mail Form 9465 if you have not filed a return yet - FileIT. For a long-term payment plan, the online setup fee is $149. The phone, mail, or in-person setup fee is $225. Low income taxpayers pay less in setup fees.

Payment - Division of Revenue - State of Delaware Need assistance with making a payment? Please contact the Division of Revenue at (302) 577-8785. Related Topics: business , make a payment , pay , pay Delaware taxes , pay division of revenue , pay gross receipts tax , pay personal income tax , pay quarterly estimated tax , pay withholding tax , payment , personal , revenue , taxes

How to set up a payment plan with IRS - ConsumerAffairs Pay setup fees: The setup fee for an installment agreement with IRS varies depending upon the plan you select. Application fees for direct debit installment agreements are $31 when you apply online...

› payPayments | Internal Revenue Service May 28, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

Montana Individual Income Tax Payment Voucher (Form IT) Montana Individual Income Tax Payment Voucher (Form IT) - Montana Department of Revenue Montana Individual Income Tax Payment Voucher (Form IT) December 30, 2021 You may use this form to make payments on your individual income taxes. You may also pay your individual income taxes using the TransAction Portal (TAP). Download

IRS Payment Options With a 1040-V Payment Voucher As of the 2020 tax year, it ranges from $31 to $225, depending on how you make your payment. There are options and reduced fees available to low-income taxpayers who qualify. This is a one-time fee that's paid upfront. It is often part of your first payment. 4 You can apply for an installment agreement on the IRS website if you owe $50,000 or less.

Post a Comment for "41 payment coupon for irs"