39 coupon rate and ytm

What are interest rates, coupon rates, yield and YTM - Times Now New bonds will also be issued at lower coupon rates. ... Yield to Maturity. In the above example, when the buyer of your bond (let's name her Charu ) buys it, she looks at a concept called 'Yield to Maturity' (YTM). YTM is the total return anticipated on a bond if the bond is held until it matures. The face value of the bond, in our ... Coupon Rate - Meaning, Calculation and Importance - Scripbox Know the Difference's between Coupon Rate & YTM. The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond.

Difference between YTM and Coupon Rates YTM is the acronym for "yield to maturity", and it measures the rate of return an investor would earn if they held a bond until it reached maturity. YTM accounts for both the interest payments made (the coupon rate) as well as any capital gains or losses. A coupon rate, on the other hand, is simply the interest rate that is paid out on a ...

Coupon rate and ytm

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. What is the difference between the YTM and the coupon rate? Answer (1 of 4): The coupon rate is the annual amount of interest a bond pays and it is fixed on the day the bond is issued for $1000. So a 5% coupon, 10-year bond will pay $50 per year for the life of the bond, no matter whether the price of that bond goes up or down between the issue date and ... Yield To Maturity Vs. Coupon Rate: What's The Difference? Yield to Maturity (YTM) The YTM is an estimated charge of return. It assumes that the customer of the bond will maintain it till its maturity date, and can reinvest every curiosity cost on the similar rate of interest. Thus, yield to maturity contains the coupon charge inside its calculation. YTM is also referred to as the redemption yield.

Coupon rate and ytm. YTM AND ITS INVERSE RELATION WITH MARKET PRICE | India Scenario 1: interest rates rose to 8.0% Increased interest rate will drive the coupon rate (8.0%) on the newly issued bonds to be higher than the coupon rate on the existing bonds (7.5%). This will lead to an increase in the YTM of the existing bond, which now equates to YTM on the newly issued bond, being 8.0%; while the market price of the ... Relationship Between Coupon Rate And Ytm For Premium Bonds Mom365 Coupon Code 2016. Alamo is located on property at the Orlando airport MCO. Avoid paying extra for on-site coupons reinvested Newark Airport Parking , and check out affordable off-site relationship between coupon rate and ytm for premium bonds parking facilities. The software is distributed through third party installers. Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author. Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

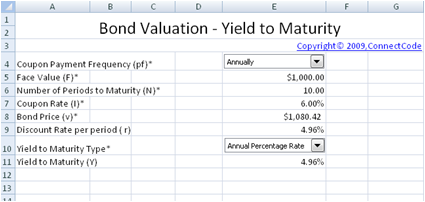

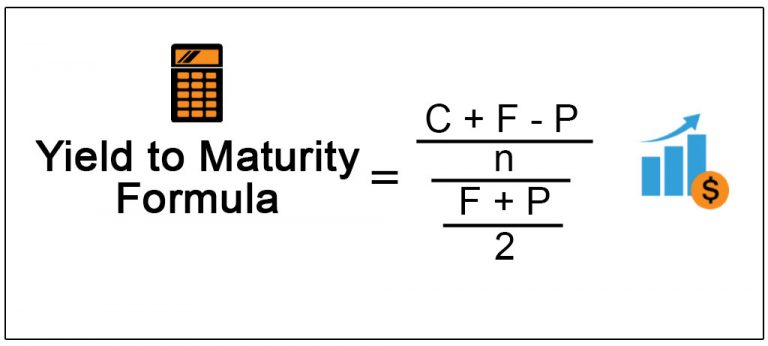

Difference Between Coupon Rate and Yield to Maturity The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver. Yield to Maturity (YTM) - Meaning, Formula and Examples The formula of current yield: Coupon rate / Purchase price. Naturally, if the bond purchase price is equal to the face value, the current yield will be equal to the coupon rate. Current Yield = 160/2,000 = 0.08 or 8%. Let's say the purchase price falls to 1,800. Current Yield = 160/1,800= 0.089 or 8.9%. The current Yield rises if the purchase ... Yield to Maturity (YTM) - Definition, Formula, Calculations Solution: Use the below-given data for calculation of YTM. We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be -. What Is a Coupon Rate? - Investment Firms Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ...

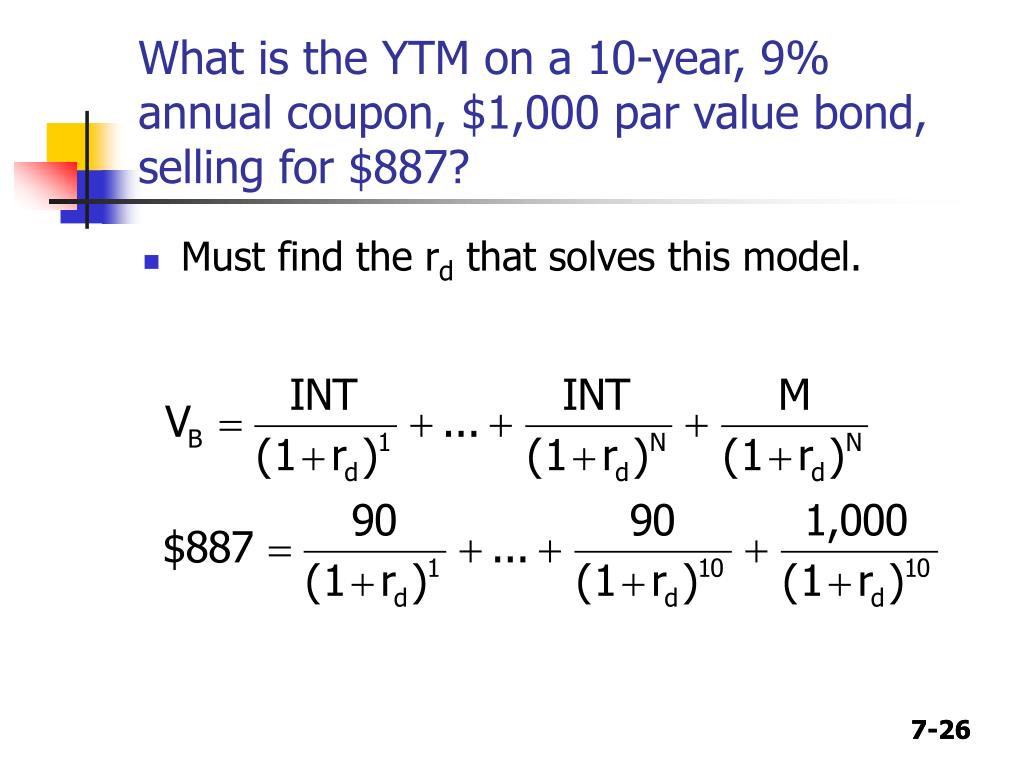

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference. Coupon Rate To Ytm Yield to Maturity (YTM) - Overview, Formula, and Importance. CODES (8 days ago) The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like ... Yield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) - i.e. the discount rate which makes the present value (PV) of all the bond's future cash flows equal to its current market price. Yield to Maturity (YTM) Formula Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the...

Coupon vs Yield | Top 5 Differences (with Infographics) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Let's see the top differences between coupon vs. yield.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Difference Between Coupon Rate and Yield of Maturity Coupon Rate. Yield of Maturity. 1. The amount paid by the issuer to the bondholder until it's maturity is called coupon rate. The yield of maturity means the total return earned by the investor until it's maturity. 2. The rate of interest is paid annually at a coupon rate.

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security. ... On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like ...

Yield To Maturity Vs. Coupon Rate: What's The Difference? Yield to Maturity (YTM) The YTM is an estimated charge of return. It assumes that the customer of the bond will maintain it till its maturity date, and can reinvest every curiosity cost on the similar rate of interest. Thus, yield to maturity contains the coupon charge inside its calculation. YTM is also referred to as the redemption yield.

What is the difference between the YTM and the coupon rate? Answer (1 of 4): The coupon rate is the annual amount of interest a bond pays and it is fixed on the day the bond is issued for $1000. So a 5% coupon, 10-year bond will pay $50 per year for the life of the bond, no matter whether the price of that bond goes up or down between the issue date and ...

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Post a Comment for "39 coupon rate and ytm"