41 are zero coupon bonds taxable

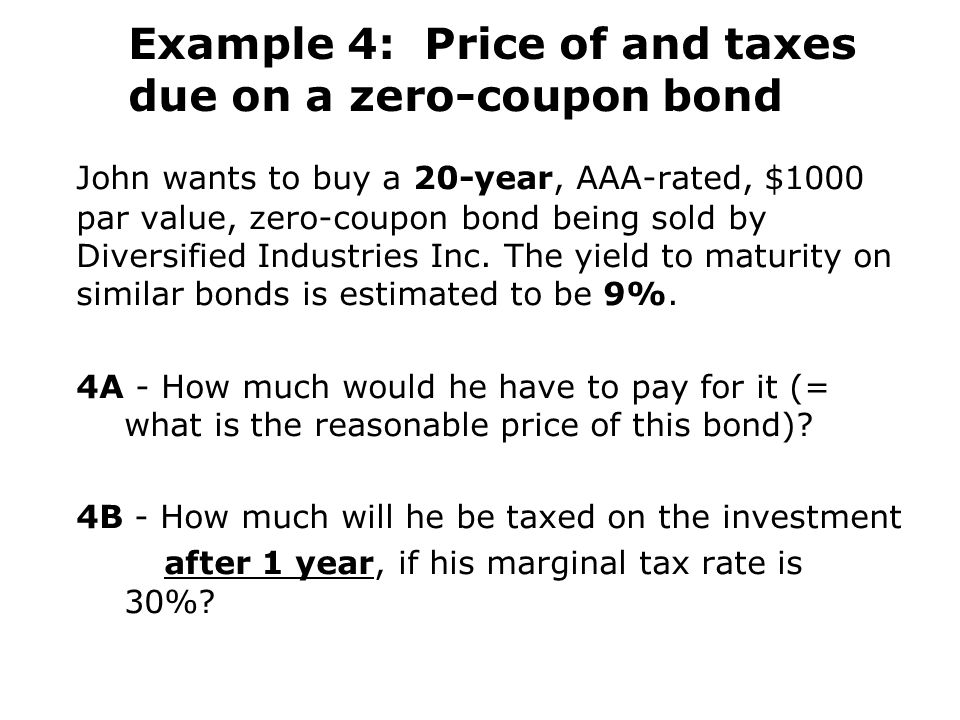

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing ... Aug 09, 2022 · Note: Muni bonds exempt from federal, state, and local taxes are known as "triple tax exempt." Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest ... Taxation Rules for Bond Investors Jan 31, 2021 · Taxation of Zero-Coupon Bonds . Although they have no stated coupon rate, zero-coupon investors must report a pro-rated portion of interest each year, as income, even though interest hasn’t been ...

Municipal Bonds - Fidelity Zero-coupon bonds Zero-coupon municipal bonds are issued at an original issue discount, with the full value, including accrued interest, paid at maturity. Interest income may be reportable annually, even though no annual payments are made. Market prices of zero-coupon bonds tend to be more volatile than bonds that pay interest regularly.

Are zero coupon bonds taxable

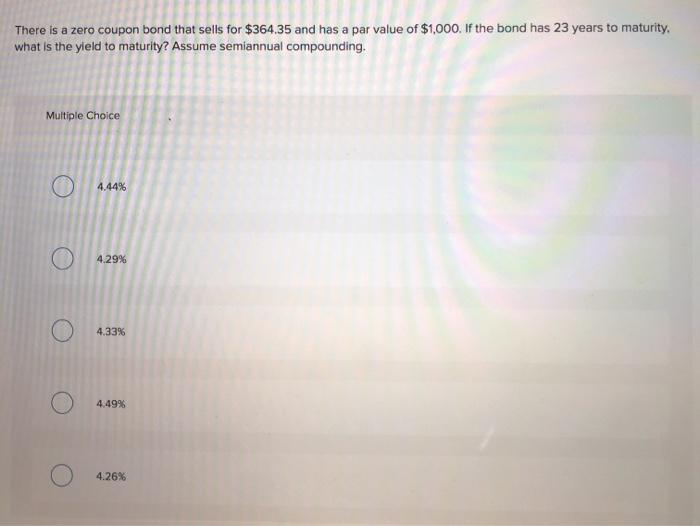

Markets Explained | Project Invested What Are High-Yield Bonds? Markets Explained. Questions to Ask. Markets Explained. An Innovative Alternative for the Income-Oriented Investor. Markets Explained. Publication 550 (2021), Investment Income and Expenses ... All debt instruments that pay no interest before maturity are presumed to be issued at a discount. Zero coupon bonds are one example of these instruments. The OID accrual rules generally do not apply to short-term obligations (those with a fixed maturity date of 1 year or less from date of issue). See Discount on Short-Term Obligations, later. Tax Treatment of Bonds and How It Differs From Stocks Feb 27, 2022 · Zero-coupon bonds have specific tax implications. These securities are sold at a deep discount and pay no annual interest. The full face value is paid at maturity, but there's a catch. The IRS computes the "implied" annual interest on the bond, and you're liable for that amount even though you don’t receive it until the bond matures.

Are zero coupon bonds taxable. The EU Mission for the Support of Palestinian Police and Rule ... Aug 31, 2022 · EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. Ultimately the Mission’s ... Tax Treatment of Bonds and How It Differs From Stocks Feb 27, 2022 · Zero-coupon bonds have specific tax implications. These securities are sold at a deep discount and pay no annual interest. The full face value is paid at maturity, but there's a catch. The IRS computes the "implied" annual interest on the bond, and you're liable for that amount even though you don’t receive it until the bond matures. Publication 550 (2021), Investment Income and Expenses ... All debt instruments that pay no interest before maturity are presumed to be issued at a discount. Zero coupon bonds are one example of these instruments. The OID accrual rules generally do not apply to short-term obligations (those with a fixed maturity date of 1 year or less from date of issue). See Discount on Short-Term Obligations, later. Markets Explained | Project Invested What Are High-Yield Bonds? Markets Explained. Questions to Ask. Markets Explained. An Innovative Alternative for the Income-Oriented Investor. Markets Explained.

:max_bytes(150000):strip_icc()/-1000-denomination-us-savings-bonds-172745598-5ad3f176a18d9e0036be9160.jpg)

Post a Comment for "41 are zero coupon bonds taxable"